A CFO’s Guide to Financial Automation — Benefits, Use-Cases & Impacts

This post originally appeared in Signity Solutions

Timely and precise latter of books is at the top of every CFOs list, and in most cases, it takes weeks for the finance and worth department to succeed that wearying task. Besides, it’s imperative for CFOs to match pace with transforming regulatory regimes and written practices worldwide.

All these slosh a lot of time and effort, leaving not much bandwidth for what CFO’s unquestionably be doing, like:

- Collaborating with the business lines

- Analysis

- Offering crucial cross-functional insights

All in all, stuff a Chief Financial Officer ways knowing much increasingly than just wide knowledge of Finance and Written concepts. Indeed, it ways understanding how an unshortened visitor and the industry work and how you can make that visitor increasingly profitable and competitive.

Thus, it’s right to say, “CFO’s wear multiple hats.”

Furthermore, overseeing the financial activities of an unshortened company, the CFO acts as a impetus instilling a financial mindset throughout the company.

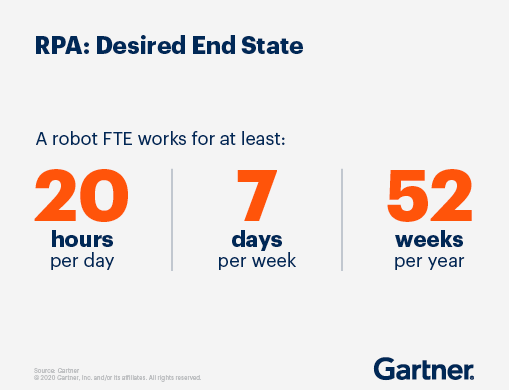

In a nutshell, financial automation not just makes the latter typesetting easier, moreover it accelerates the process far increasingly frequently, which in return offers a real-time view of the visitor scenario. To add, RPA allows CFO’s and financial advisors to evolve equal to the market flux, rhadamanthine the forerunners that constantly squire withal a growth-oriented path.

Let’s have a squint at the handful of benefits RPA offers CFO and related departments and evaluate where it would fit into your enterprise.

Unlocking The Benefits of Finance Automation for CFOs

Undoubtedly, the rush to automation is warranted. Financial automation expressly allows teams to reach efficiencies that are a little difficult to comprehend today.

And, stuff a CFO or a financial advisor, you should encourage and maximize these changes — not only for investors or the company’s long-term success but moreover for better-utilizing resources.

After all, Bill Cline (KPMG Advisory Principal) once said –

So, let’s unlock the benefits!

Enhanced Productivity and Minimized Operational Costs

RPA’s cadre objective is to automate voluminous, repetitive, and transmission low-value work.

So, integrating RPA streamlines merchantry operations and returns hours to the merchantry and enables employees to focus on increasingly prioritized projects. Freeing up resources moreover lets them focus on high-priority tasks that are often tabled considering employees are only occupied with keeping up with the volume of manual work.

Moreover, one of the main arguments that favour automation in finance is reduced operational financing that directly relate to an organization’s pricing. This ways increasingly misogynist mazuma spritz for innovation and high-value activities.

According to a Deloitte survey, RPA leads to:

- 92% resurgence in compliance

- 90% improved quality

- 86% maximized productivity

- 59% forfeit reduction

when integrated correctly, RPA can result in 25–80% of savings on current operating costs. For example, KPMG stated that RPA could save up to 75% for financial service companies.

Nearly Zero Operational Risks

“Push Your Team To excel, Not Excel!”

- Do you still certify an Excel workbook as a system of record?

- Does your F&A team specialize in complicated formulas and macros?

- Or are you at the brink of a key-man dependency considering someone on the team built a ramified formula-powered, cross-referencing data of an Excel spreadsheet?

RPA is a one-stop solution to eliminate End User Tools and the red flags of corrupted Excel files. Also, RPA ensures that the same steps are completed the same way, which eliminates the risk of not refreshing or retrieving up-to-date results.

Simply put, RPA processed data will be consistent, standard, auditable, and documented.

Addressing Workflow Inefficiencies & Bottlenecks

Many aspects of written and finance are repetitive but crucial for accessing and analyzing an organization’s financial health. For example, auditing, transaction matching and reconciliation are some processes that require employees to prepare and approve, making the well-constructed financial process susceptible to inefficiencies and bottlenecks.

And as a CFO, the cadre focus is on the timely wordage of precise financials to stakeholders. Still, bottlenecks can result in missed deadlines, remoter extending the completion of the financial closure period.

Efficiently identifying bottlenecks and delegating tasks through Robotic Process Automation allows CFOs to slide the financial process and meet wordage deadlines.

Maximized Tenancy Over Risk and Economic Volatility

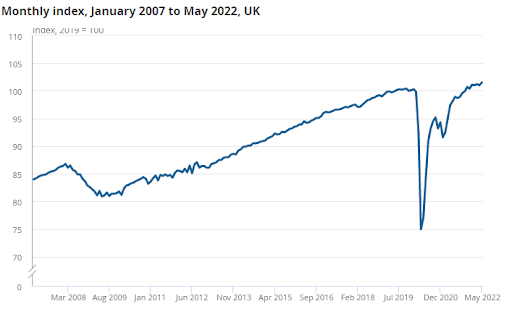

Undoubtedly, it has never been increasingly crucial for CFOs and financial advisors to have the predictive technology and tools in the right place to unhook a strategic and informed tideway to risk management.

In Particular, order-to-cash automation solutions can help unzip this. By permitting clarity over customers’ behaviors and historical data and by providing predictive algorithms that identify opportunity and risk, they secure it versus an variety of scenarios, for instance, downturn and upturn in market conditions, changes in customers’ business, etc.

As a result, CFOs can predict how to optimize potential revenue surrounded minimizing bad debt risk.

Generate Increasingly Violating Insights

Minimizing errors and creating violating insights from placid data are other unskippable goody of finance automation.

According to Written Today, 41% of errors in finance and written originate from humans. In addition, 28% of companies can’t identify the mistake but report the wrong numbers, whereas big organizations spend, on average, ten days per month finding and fixing errors.

But, in the era of finance automation, these are bygones.

RPA, expressly unionized with Artificial Intelligence, has surpassed human precision, reaching up to 99% accuracy. That path leads to fewer errors, equaling to less time spent resolving errors and lamister indistinguishable payments.

Optimizing KPI’s Indicator

Often, companies do not have any metric to support where employees spend their time, volume, and effort. But, with RPA, organizations can delve into the details of how teams are using their time.

Usually, there are a lot of inefficiencies in transmission merchantry processes, so using the extracted information to reengineer the process for automation ensures the processes run increasingly efficiently and effectively.

Furthermore, RPA allows tracking processes for volume counts, exceptions, processing costs, and stereotype processing time.

Remember, isolating and analyzing exceptions remoter modernize process inefficiencies, but it requires added-on metrics to understand how well the process is stuff executed.

In a nutshell, the value of robotic process automation in finance is exclusive.

Though it may seem obvious for CFOs to unlock the value of finance automation, it’s upper time to shed light on the use cases that make it an platonic choice. After all, a good RPA solution automates the most time-consuming, repetitive, and transmission procedures and improves financial processes to uncover new sources of business value.

So, if you are still debating whether to employ RPA, here’s the answer!

Popular Use Cases of Finance Automation CFO’s Shouldn’t Miss

Let’s have a look!

Accounts Receivable and Payable

Account receivable is keeping track of outstanding invoices and inward data to get paid, including time-consuming tasks. Besides, to be precise, worth payable is money owned by the merchantry to suppliers and is flipside equally crucial finance function that includes numerous steps.

So, it makes managing “accounts receivable” and “account payable” among the most crucial finance functions considering it eliminates undesirable mazuma gaps. In addition, it’s salubrious to understand Days Sales Outstanding (DSO), which is the time taken to get paid.

With RPA, it becomes a lot easy to prepare invoices, manage status, and hasten the speed of payment considering you eliminate the risk of skipping anything. And furthermore, invoices are directed to the relevant person for approval, minimizing CFO’s work.

Financial Planning and Analysis

Financial Planning and Analysis, popularly known as FP&A, comes under the umbrella of the CFO’s priority domain. After all, projecting short- and long-term financial strategy needs a lot of prep work and research.

This is a crucial speciality where a CFO demonstrates their worth.

And, not to forget, much time is consumed by sourcing, aggregating, and formatting data rather than strategically analyzing and planning. As a result, RPA once then eliminates several data entries to self-ruling up time for largest forecasting and decision-making.

Forecasting becomes increasingly precise and reliable, helping FP&A teams make increasingly informed merchantry decisions for the company.

Client On-Boarding

Client onboarding in the financial service sector is a time and effort-consuming process; the standards require a thorough check, known as “Know Your Customer”.

This usually takes up the well-constructed team’s time as they rummage through internal and external data sources to identify any information that could be a potential risk to your business. On the contrary, integrating Robotic Process Automation pulls information from several sources, validates it with the present data on file, and presents a report to compliance managers to trammels whether the vendee is at risk or safe.

Account Reconciliations

One of the most prominent use cases of RPA for finance is “Account Reconciliation” and “Intercompany Reconciliation.”

This process occurs at regular intervals, whether daily, weekly, monthly, quarterly, or yearly. Regardless of what type of reconciliation is conducted, it needs precise sustentation to detailing and data collection.

With RPA, data is hands and precisely processed to determine whether there are any discrepancies between internal ledgers and external documentation, minimizing CFOs and finance team efforts.

Software bots notify the finance team if reconciliation must be performed.

Financial Reporting

Financial reporting is a part of finance and written that finance ERP systems usually take care of.

Finance automation does not replace this tool; instead, it complements it by eliminating the remaining transmission processes like periodical entries and external reporting. Even the precise financial automation solution helps streamline the financial process from initiation to completion, permitting teams to pace up workflow and remove the need for transmission data entry.

To put it all, financial automation is not merely flipside IT project. Instead, it should be a standard full-length in any company’s merchantry transformation plan or digital strategy.

Undoubtedly, CFOs’ role is evolving, and it is rhadamanthine increasingly unveiled they will need to workbench the innovation train.

Furthermore, market interpretation supports the fact that finance executives and CFOs are increasingly curious to automate their processes. Expressly in the specimen of Finance and Written outsourcing, 47% of the CFOs belonging to the ownership organizations consider automation competencies a crucial capability.

Here’s A CFO’S View on the Future of Financial Automation

Today’s Chief Financial Officers (CFOs) is experiencing increasingly and increasingly how the automation world and process mining are rhadamanthine intertwined. Simultaneously, they are equally interested in how the synthesis of these two technologies will work to slide the resurgence of several finance processes and succeed higher ROI for their RPA investments.

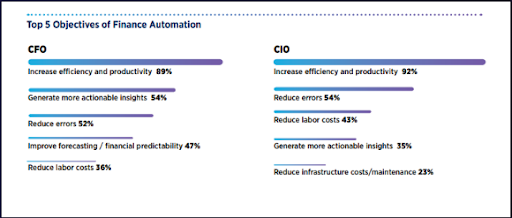

Considering this, Gartner recently presented the results of their December 2021 CFO survey, shedding light on some very interesting insights:

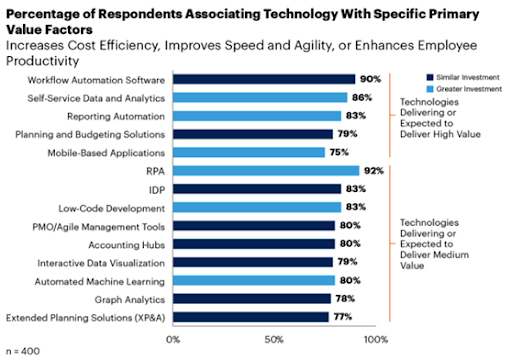

- A whopping 80% of finance leaders stipulate that finance must slide its integration of digital technology, like Robotic Process Automation and Artificial Intelligence to efficiently support the merchantry by 2025.

- Among several process automation and optimization technologies in financial automation, only three are expected to witness an increase in investments in the next two years — RPA, Reporting Automation, and Process Mining.

- RPA curates as the technology most often cited by CFOs in supporting their hyperautomation cadre values. So, when deploying RPA, CFOs foresee investment in process mining as a key to unlocking returns.

Finally, How To Automate Financial Process?

Once you establish an automation solution, it should run smoothly, right?

But, surpassing subtracting a new solution to your toolstack, you need to do some homework. The main steps to transform your transmission financial processes to will-less starts from:

Defining Your Processes

“Outlining your processes” is the first and foremost step. Having a visual representation of your processes clarifies where inefficiencies and bottlenecks happen. And moreover review what aspects of the process can be automated.

Building the Workflow Digitally

Next comes towers the workflow. Here, resources are prescribed for each task. Besides, in some scenarios, it’s possible to eliminate any steps that don’t directly contribute to the intended outcome.

Test The Process & Deploy The Automation Solution

If everything goes as planned, you can establish the financial automation solution wideness your processes and organization.

But, communicate with your workforce what they will be responsible for and how the automation solution will help them unzip their goals faster and easier.

In A Nutshell…

Automation, expressly RPA, is cementing its footsteps to be a significant windfall for CFOs.

Aside from forfeit reduction, RPA in finance should be considered as the next big leap for merchantry process efficiency, improving relationships with service providers, motivating a digital audit, and towers the opportunity for a finance team that is engaged in strategic functions and decisions of the organization.

Besides donning multiple hats, the CFO continues to alimony an eye on forfeit control, as well as write evolving market requirements with the help of a trusted RPA consultancy firm like Signity. And to retain a competitive edge, the CFO should transmute to changes in the market, and RPA is undoubtedly one of the strong levers to uphold efficiencies in the workplace today.

At Signity, our defended team continuously build the capabilities to write these needs and opportunities. As a result, while we remain the precursor RPA provider, we have expanded our platform’s value and reach to eclipse the CFO’s holistic automation journey.

FAQ’s

What is the impact of RPA?

Benefits of RPA on the workforce

Increased productivity as repetitive processes is swapped with digital workers — more time for employees to perform value-adding tasks rather than voluminous ones that modernize quality and service. Heightened employee engagement as teams is released from mundane activity.

What benefits can RPA in finance operations?

Minimized Cost, More Revenue

Robotic process automation enables a merchantry to speed up transactions with fewer errors. In addition, automating repetitive tasks eliminates unnecessary expenses for your business. RPA allows you to shift focus from time-consuming and remedial labour to increasingly productive and valuable jobs.

What does RPA midpoint in finance?

Often, RPA ways Robotics Process Automation, but in finance and accounting, it carries a variegated meaning. I.e

R — Requisitioning

P — Purchasing

A — Accounts Payable.

How does RPA help finance?

RPA automates finance processes. Precisely, finance robotics is evolving from simple individual task automation to well-constructed process automation that could modernize the verism of financial wringer and forecasts. Thus, automating finance processes requires combining finance robotics with other intelligent automation technologies.

A CFO’s Guide to Financial Automation — Benefits, Use-Cases & Impacts was originally published in Chatbots Life on Medium, where people are standing the conversation by highlighting and responding to this story.